Mileage refund calculator

To work out how much you can claim for each tax year youll need to. Click on New Expense and select Personal Car Mileage from the list in the Expense Tab on the right side of the screen you can more easily find the expense type by.

How To Calculate Your Mileage For Taxes Or Reimbursement

Then you multiply them by the correct mileage rate.

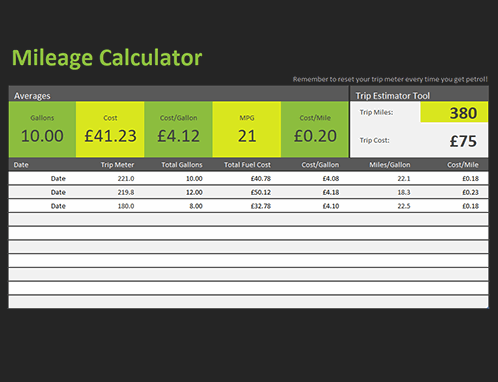

. You can improve your MPG with our eco-driving. You keep track of your miles driven for IRS-approved purposes business medical activity moving or charitable work. For a location missing from the drop down type a street.

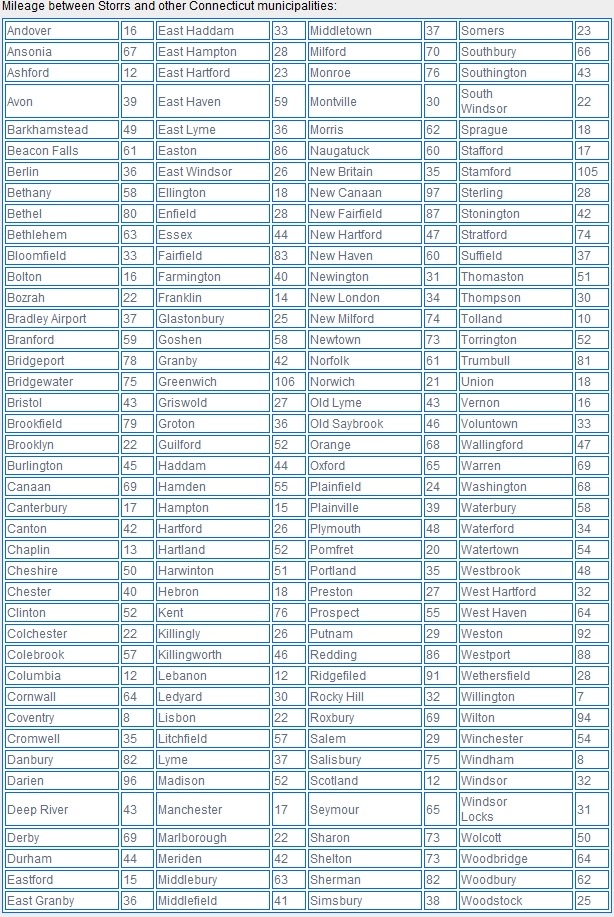

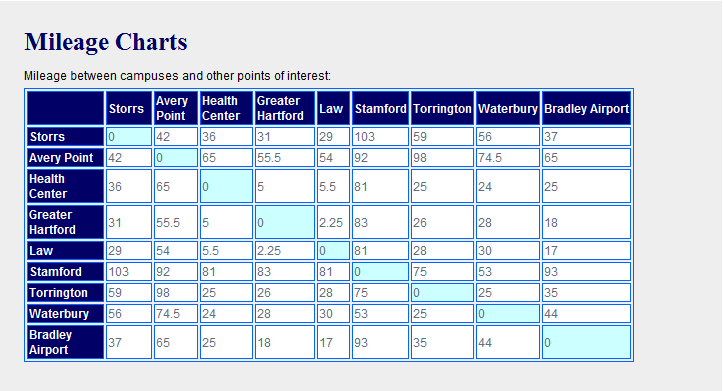

Type the location name in the From and To fields. Mileage tax relief is by far the largest part of most tax refund claims and refund claims can stretch back over 4 years. Calculate the mileage of a flight between airports or the mileage of a car between addresses.

Input the number of miles driven for business charitable medical andor moving purposes. Click on the Calculate button to determine the. Cars and vans after 10000 miles.

The questions below relate to your current and previous jobs since April 2017. Mileage calculator Enter your route details and price per mile and total up your distance and expenses. The mileage tax relief calculator uses the current approved mileage rates of 45p per mile for the first 10000 business miles and 25p per mile for every business mile after that.

Routes are automatically saved. For the final 6. Enter a start and end point into the tool and click the calculate mileage.

Heres how much you can claim per mile. You may also be able to claim a tax deduction for mileage in a few other. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

Mileage Calculator The Rand McNally mileage calculator will help you determine the mileage between any two destinations. This means the maximum miles youd be able to claim as undriven would be 9000 - an 18 refund. Select the location from each drop down.

Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Select your tax year. Car Fuel Allowance 45p for each mile for the first 100000 miles Motorcyclists 24p for each mile Cyclists 20p for each mile It doesnt matter.

Kick off your HMRC tax refund claim with RIFTs mileage claim calculator. Keep records of the dates and mileage of your work journeys add up the mileage for each vehicle type youve used for. Mileage Calculator Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States.

To achieve this maximum 18 refund youd need to have driven 0 miles over this nine. To use our calculator just input the type of vehicle and the business miles youve.

How To Calculate Your Mileage For Reimbursement Triplog

Vehicle24x7 Mileage Calculator Apps On Google Play

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Smart Mileage Calculator For Vehicle Users Mileagewise

2021 Mileage Reimbursement Calculator

How Do I Calculate My Personal Car Mileage Expense Columbia Travel Expense

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

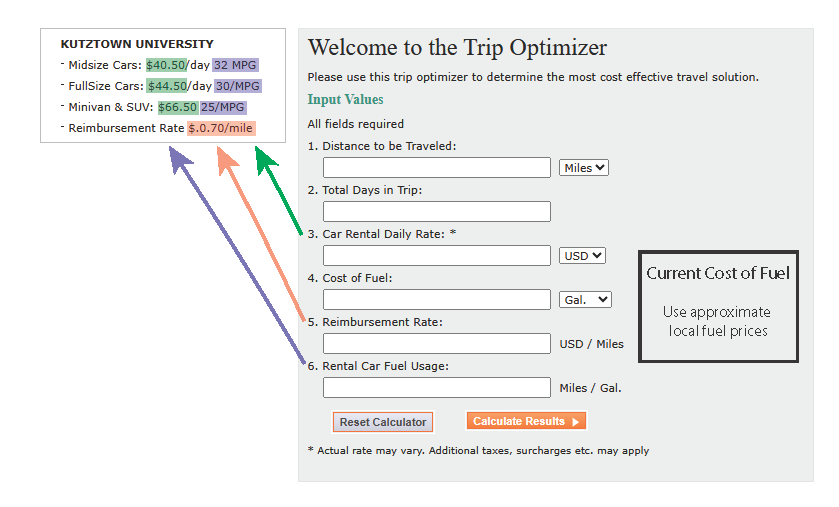

Mileage Calculation Accounts Payable

Mileage Calculation Accounts Payable

Mileage Calculator Credit Karma

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Mileage Calculator

Vehicle Mileage Calculator Kutztown University

Irs Mileage Rate For 2022

How To Calculate Your Mileage For Reimbursement Triplog

Mileage Reimbursement Calculator

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs